【量化】4天学会python机器学习与量化交易-笔记2(p16~p20)

平台:https://www.ricequant.com/quant/#?tag=algorithm-ol&id=1339040

api1:https://www.ricequant.com/doc/rqdata-institutional#research-API-get_fundamentals

api2:https://www.ricequant.com/doc/api/python/chn#wizard-stock

多读书,多看“报”(证券研究报告)

视频:https://www.bilibili.com/video/av55456917?p=17

代码:

def init(context):

context.hs300 = index_components("000300.XSHG")

# before_trading此函数会在每天策略交易开始前被调用,当天只会被调用一次

def before_trading(context):

# 获取过滤的股票

q = query(

fundamentals.eod_derivative_indicator.market_cap

).order_by(

fundamentals.eod_derivative_indicator.market_cap

).filter(

fundamentals.stockcode.in_(context.hs300)

).limit(20)

funds = get_fundamentals(q)

# 获得10只股票的名字

context.stock_list = funds.T.index

def handle_bar(context, bar_dict):

# 卖出

# 去positions里面获取仓位

for stock in context.portfolio.positions.keys():

if stock not in context.stock_list:

order_target_percent(stock, 0)

# 买入

for stock in context.stock_list:

order_target_percent(stock, 1.0/20)

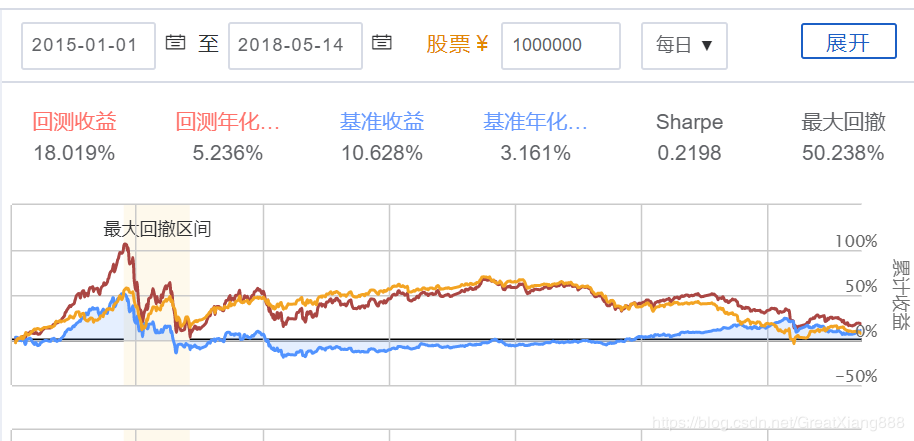

结果:

视频:https://www.bilibili.com/video/av55456917?p=18

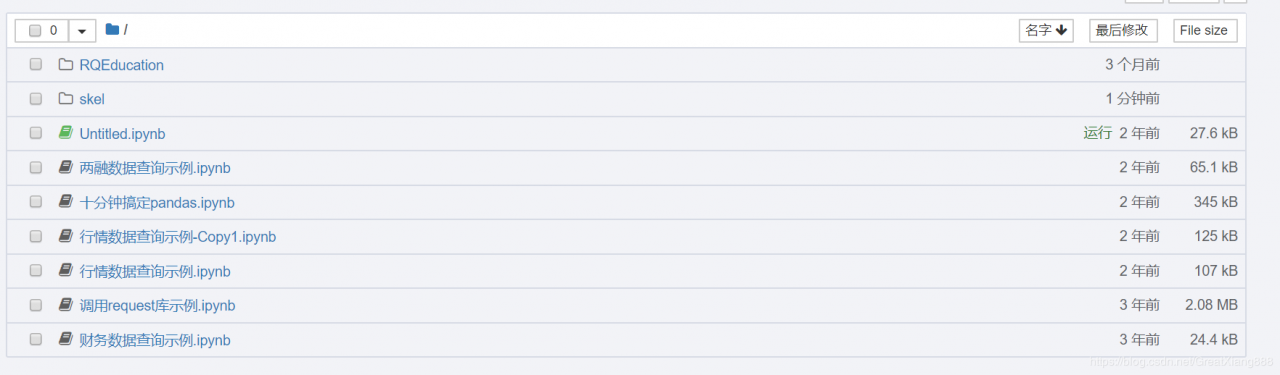

notebook位置:https://www.ricequant.com/research/user/user_358930/tree?

(原来以为功能被删了,后来直接输入网址找到了)

(两年前玩过一会这个,可是基础太差直接放弃了。一转眼研究生都快读完了,重新拾起,这个方向肯定是我要研究的,给自己一个期限,看5年后是否能有所建树。)

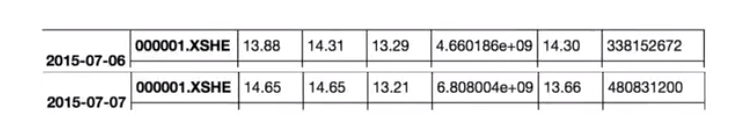

1,研究平台api

get_price(“000001.XSHE”, start_date=“2017-01-01”, end_date=“2017-01-06”) #一只股票 get_price([“000001.XSHE”, “000005.XSHE”, “000002.XSHE”], start_date=“2017-01-01”, end_date=“2017-01-06”, fields=“close”) #多只股票 get_trading_dates(start_date=“2017-01-01”, end_date=“2018-01-01”) #获取交易日日期 fund = get_fundamentals(q, entry_date=‘2017-01-03’)# 获取财务数据

q = query(fundamentals.income_statement.revenue,

fundamentals.income_statement.cost_of_goods_sold

).filter(fundamentals.stockcode.in_(['000001.XSHE', '000002.XSHE']))

fund = get_fundamentals(q, entry_date='2017-01-03')

fund

结果:

Dimensions: 2 (items) x 1 (major_axis) x 2 (minor_axis)

Items axis: revenue to cost_of_goods_sold

Major_axis axis: 2017-01-03 00:00:00 to 2017-01-03 00:00:00

Minor_axis axis: 000001.XSHE to 000002.XSHE

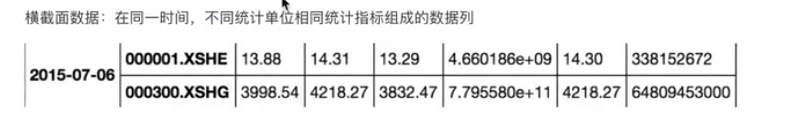

2,数据的组成

序列数据:不同时间点上收集的数据,反映了某一事物、现象随时间的变化状态或程度

序列数据:不同时间点上收集的数据,反映了某一事物、现象随时间的变化状态或程度 面板数据转换成截面数据

面板数据转换成截面数据fund[:, ‘2017-01-03’,:]

3,多因子数据的处理

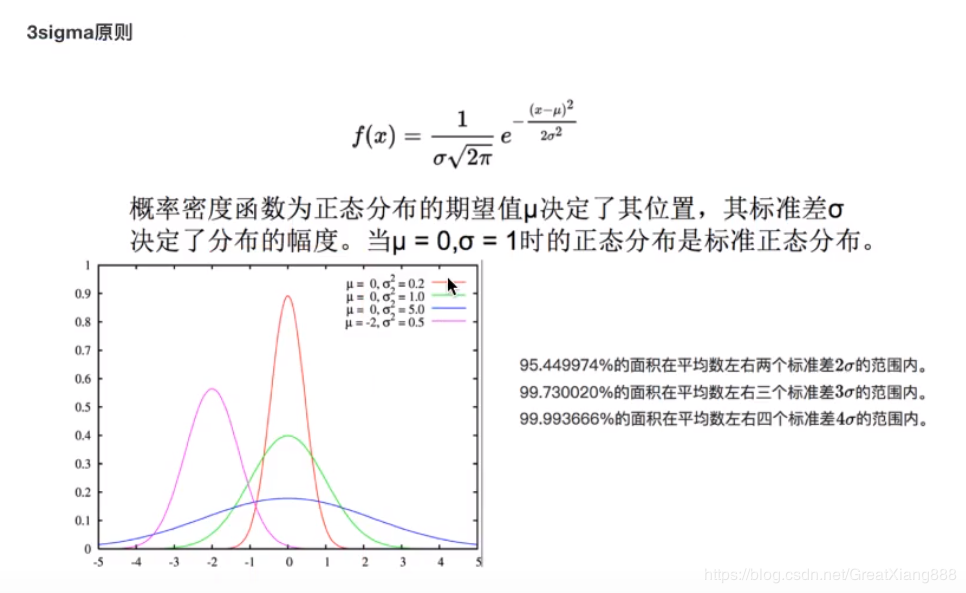

多因子分析使用的是截面数据。 因子数据的处理– 并不是去除异常数据,而是拉回到正常值。 三种方法:

– 分位数去极值:中位数,四分位数,百分位数

– 中位数绝对偏差去极值

– 正态分布去极值 p19 案例:中位数去极值和3背中位数去极值

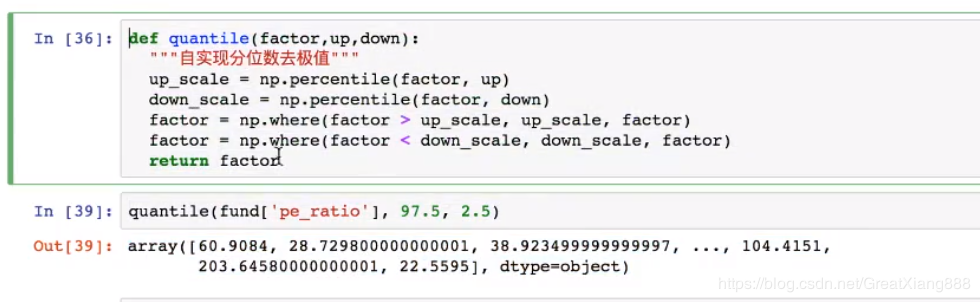

视频:https://www.bilibili.com/video/av55456917?p=19

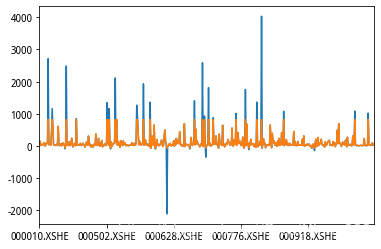

四分位数:从小到大排列,排第25%,50%,75%位置的数

指定分位区间以外的数用分位点替换

1,

代码:

from scipy.stats.mstats import winsorize

# 对pe_ratio进行去极值

fund = get_fundamentals(query(fundamentals.eod_derivative_indicator.pe_ratio), entry_date='20170103')[:, '20170103', :]

fund['pe_ratio_winsorize'] = winsorize(fund['pe_ratio'], limits=0.025)

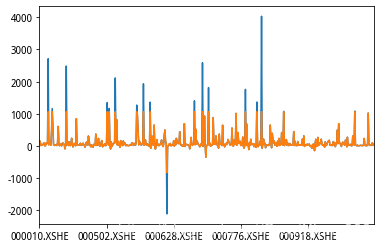

fund['pe_ratio'][:500].plot()

fund['pe_ratio_winsorize'][:500].plot()

结果:

自实现分位数:

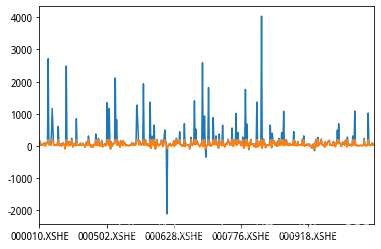

2,中位数绝对偏差去极值

3倍中位数去极值(常用)import numpy as np

def mad(factor):

'''中位数绝对偏差去极值'''

# 1,找出中位数

me = np.median(factor)

# 2,得到每个因子值与中位数的绝对偏差值 |x-median|

# 3,得到绝对偏差的中位数mad = median(|x-median|)

mad = np.median(abs(factor - me))

# 4,计算MAD_e = 1.4826*MAD,然后确定参数n,做出调整

# n取3,表示3倍中位数去极值

# 求出3倍中位数的上下限

up = me + (3* 1.4826* mad)

down = me - (3* 1.4826* mad)

# 利用上下限去极值

factor = np.where(factor>up, up, factor)

factor = np.where(factor<down, down, factor)

return factor

#对pe_ratio去极值

fund['pe_ratio_3md'] = mad(fund['pe_ratio'])

fund['pe_ratio'][:500].plot()

fund['pe_ratio_3md'][:500].plot()

结果:

视频:https://www.bilibili.com/video/av55456917?p=20

(老师说不常用)

代码:

# 3sigma方法去极值

def threesigma(factor):

# 计算平均值和标准差

mean = factor.mean()

std = factor.std()

# 计算上下限的数据

up = mean + 3*std

down = mean - 3*std

# 替换极值

factor = np.where(factor>up, up, factor)

factor = np.where(factor<down, down, factor)

return factor

#对pe_ratio去极值

fund['pe_ratio_3sigma'] = threesigma(fund['pe_ratio'])

fund['pe_ratio'][:500].plot()

fund['pe_ratio_3sigma'][:500].plot()

结果:

去极值:推荐中位数绝对偏差去极值,其次用分位数。

作者:机智翔学长