Python+MYSQL+SKLearn对国内商品期货聚类

参考了SKLearn官网上的示例Visualizing the stock market structure

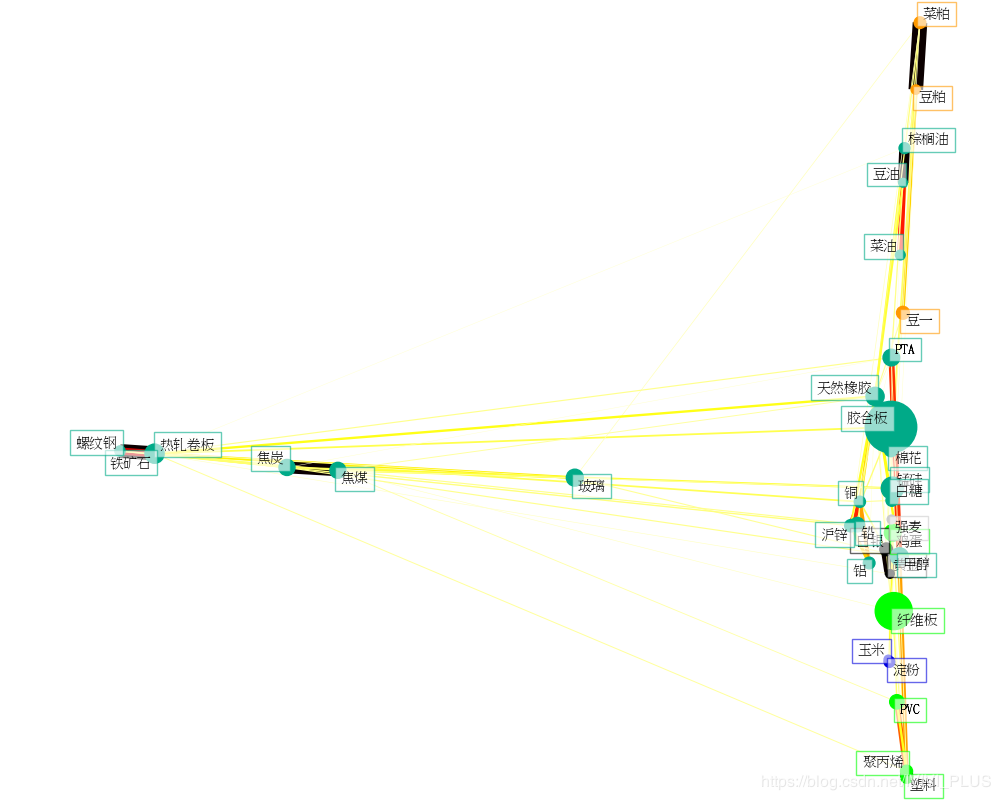

结果如图:

sudo apt install mysql-server

sudo mysql

sudo打开mysql后创建名为ClusteringFutures的数据库,并创建和授权一般用户。Ctrl+c退出

CREATE DATABASE ClusteringFutures;

USE ClusteringFutures;

CREATE USER 'IVIVI_PLUS'@'localhost' IDENTIFIED BY '123456';

GRANT ALL PRIVILEGES ON ClusteringFutures.* TO 'IVIVI_PLUS'@'localhost';

FLUSH PRIVILEGES;

验证以上操作,以一般用户进入数据库。

mysql -u IVIVI_PLUS -p ClusteringFutures

至此,MYSQL准备工作完成。

Python端基本流程:

1、从新浪财经获取国内商品期货的日K线数据。

2、数据导入MYSQL

3、清洗数据

4、计算单日涨跌幅,作为聚类模型训练的输入

5、SKLearn聚类

6、Matplotlib进行可视化

import requests

import pymysql

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.collections import LineCollection

from sklearn import cluster, covariance, manifold

# 商品期货代码与名称字典

# symbol_dict = {

# 'TA0': 'PTA',

# 'OI0': '菜油',

# 'RS0': '菜籽',

# 'RM0': '菜粕',

# 'ZC0': '动力煤',

# 'WH0': '强麦',

# 'JR0': '粳稻',

# 'SR0': '白糖',

# 'CF0': '棉花',

# 'RI0': '早籼稻',

# 'MA0': '甲醇',

# 'FG0': '玻璃',

# 'LR0': '晚籼稻',

# 'SF0': '硅铁',

# 'SM0': '锰硅',

# 'CY0': '棉纱',

# 'AP0': '苹果',

# 'CJ0': '红枣',

# 'V0': 'PVC',

# 'P0': '棕榈油',

# 'B0': '豆二',

# 'M0': '豆粕',

# 'I0': '铁矿石',

# 'JD0': '鸡蛋',

# 'L0': '塑料',

# 'PP0': '聚丙烯',

# 'FB0': '纤维板',

# 'BB0': '胶合板',

# 'Y0': '豆油',

# 'C0': '玉米',

# 'A0': '豆一',

# 'J0': '焦炭',

# 'JM0': '焦煤',

# 'CS0': '淀粉',

# 'EG0': '乙二醇',

# 'FU0': '燃料油',

# 'SC0': '上海原油',

# 'AL0': '铝',

# 'RU0': '天然橡胶',

# 'ZN0': '沪锌',

# 'CU0': '铜',

# 'AU0': '黄金',

# 'RB0': '螺纹钢',

# 'WR0': '线材',

# 'PB0': '铅',

# 'AG0': '白银',

# 'BU0': '沥青',

# 'HC0': '热轧卷板',

# 'SN0': '锡',

# 'NI0': '镍',

# 'SP0': '纸浆'}

symbol_dict = {

'TA0': 'PTA',

'OI0': '菜油',

'RM0': '菜粕',

'WH0': '强麦',

'SR0': '白糖',

'CF0': '棉花',

'MA0': '甲醇',

'FG0': '玻璃',

'SM0': '锰硅',

'V0': 'PVC',

'P0': '棕榈油',

'M0': '豆粕',

'I0': '铁矿石',

'JD0': '鸡蛋',

'L0': '塑料',

'PP0': '聚丙烯',

'FB0': '纤维板',

'BB0': '胶合板',

'Y0': '豆油',

'C0': '玉米',

'A0': '豆一',

'J0': '焦炭',

'JM0': '焦煤',

'CS0': '淀粉',

'AL0': '铝',

'RU0': '天然橡胶',

'ZN0': '沪锌',

'CU0': '铜',

'AU0': '黄金',

'RB0': '螺纹钢',

'PB0': '铅',

'AG0': '白银',

'HC0': '热轧卷板'}

# 将期货字典的keys和values排序后,分别存入symbol_list和names备用

symbol_list, names = np.array(sorted(symbol_dict.items())).T

# 将symbol从np.array转为list

symbol_list = list(symbol_list)

# 创建期货数据表的函数

def creat_future_table(symbol):

future_code = symbol

# 向新浪财经api请求历史数据

url_str = ('http://stock2.finance.sina.com.cn/futures/api/json.php/IndexService.getInnerFuturesDailyKLine?symbol=' +

future_code)

r = requests.get(url_str)

daily_klines = r.json()

daily_klines_lists = list(daily_klines)

# 数据写入数据库,表格名为期货代码

future_db = pymysql.connect('localhost', 'IVIVI_PLUS', '123456', 'ClusteringFutures')

cursor = future_db.cursor()

# 如果已存在该期货表格,则删除

cursor.execute("DROP TABLE IF EXISTS " + future_code)

# 创建表格,“交易日期”(主键)、开盘价、最高价、最低价、收盘价、成交量

sql = "CREATE TABLE " + future_code + """ (

price_date DATE NOT NULL PRIMARY KEY,

open_price DECIMAL(19, 4),

high_price DECIMAL(19, 4),

low_price DECIMAL(19, 4),

close_price DECIMAL(19, 4),

volume BIGINT)"""

# 运行创建表格的sql语句

cursor.execute(sql)

# 插入数据(ps:新浪api返回数据转字符串时会多余'['和']',所以进行切片)

for i in daily_klines_lists:

sql = "INSERT INTO " + future_code + """ (price_date, open_price, high_price, low_price, close_price, volume)

VALUES (""" + str(i)[1:-1] + ")"

try:

# 执行sql语句

cursor.execute(sql)

# 提交到数据库执行

future_db.commit()

except:

print('rollback table %s' %s (future_code))

# 如果发生错误则回滚

future_db.rollback()

# 关闭数据库连接

future_db.close()

# 删除表格中垃圾数据行的函数

def delete_rows(symbol):

future_code = symbol

future_db = pymysql.connect('localhost', 'IVIVI_PLUS', '123456', 'ClusteringFutures')

cursor = future_db.cursor()

# 简单认为,开盘价或收盘价或成交量是0的行为垃圾数据

sql = "DELETE FROM " + future_code + " WHERE open_price = 0 OR close_price = 0 OR volume = 0"

cursor.execute(sql)

future_db.commit()

future_db.close()

# 返回一个表格中,全部交易日期的函数

def select_columns(symbol):

future_code = symbol

future_db = pymysql.connect('localhost', 'IVIVI_PLUS', '123456', 'ClusteringFutures')

cursor = future_db.cursor()

sql = "SELECT price_date FROM " + future_code

cursor.execute(sql)

r = cursor.fetchall()

future_db.close()

return r

# 查询某期货某一天的某项数据的函数

def select_a_data(symbol, date, data_name):

future_code = symbol

future_db = pymysql.connect('localhost', 'IVIVI_PLUS', '123456', 'ClusteringFutures')

cursor = future_db.cursor()

sql = "SELECT %s FROM " % data_name + future_code + " WHERE price_date = \'" + date + "\'"

cursor.execute(sql)

r = cursor.fetchall()

future_db.close()

return r

print('对 %d 只期货进行聚类' % len(symbol_list))

# 对symbol_list中的所有期货创建数据表,并删除垃圾行

for s in symbol_list:

print(symbol_dict[s])

creat_future_table(s)

delete_rows(s)

# 找出symbol_list中的所有期货的共有交易日

date_set_list = [] # 交易日组成的集合的列表(为了方便后续的求交集工作,所以转为集合)

for s in symbol_list:

r = select_columns(s)

date_set_list.append(set(r))

com_date_set = date_set_list[0] # 共有交易日集合,初始等于第一支期货的交易日集合

# 对date_set_list中的全部日期集合求交集,获得共有交易日

for i in range(len(symbol_list)):

com_date_set = com_date_set.intersection(date_set_list[i])

com_date_list = list(com_date_set)

com_date_list.sort()

# 将共有交易日以字符串形式保存,方便后续使用

str_com_date_list = []

for i in com_date_list:

str_com_date_list.append(str(i[0]))

# 打印共有交易日天数

print('将要聚类的期货共有 %d 条有效交易数据' % len(str_com_date_list))

# 将共有交易日的收盘价和开盘价转为np.array格式

# 转置后每一列是同一个期货每个交易日的收盘价或开盘价

# 行数为交易日天数,列数为期货数量

close_prices_list = []

for s in symbol_list:

tmp_list = []

for date in str_com_date_list:

tmp_list.append(select_a_data(s, date, 'close_price')[0][0])

else:

close_prices_list.append(tmp_list)

close_prices = np.array(close_prices_list).T

open_prices_list = []

for s in symbol_list:

tmp_list = []

for date in str_com_date_list:

tmp_list.append(select_a_data(s, date, 'open_price')[0][0])

else:

open_prices_list.append(tmp_list)

open_prices = np.array(open_prices_list).T

# 计算每个期货的每个单日涨跌幅数组作为模型输入

X = (close_prices - open_prices) / open_prices * 100

# 查看输入形状

print('验证输入数据形状')

print(X.shape)

# 使用sk_learn预设模型进行聚类

edge_model = covariance.GraphicalLassoCV()

edge_model.fit(X)

_, labels = cluster.affinity_propagation(edge_model.covariance_)

n_labels = labels.max()

# #############################################################################

# Find a low-dimension embedding for visualization: find the best position of

# the nodes (the stocks) on a 2D plane

# We use a dense eigen_solver to achieve reproducibility (arpack is

# initiated with random vectors that we don't control). In addition, we

# use a large number of neighbors to capture the large-scale structure.

node_position_model = manifold.LocallyLinearEmbedding(

n_components=2, eigen_solver='dense', n_neighbors=6)

embedding = node_position_model.fit_transform(X.T).T

# #############################################################################

# Visualization

plt.rcParams['font.sans-serif'] = ['TW-Sung'] # 指定中文字体,解决中文乱码

plt.figure(1, facecolor='w', figsize=(10, 8))

plt.clf()

ax = plt.axes([0., 0., 1., 1.])

plt.axis('off')

# Display a graph of the partial correlations

partial_correlations = edge_model.precision_.copy()

d = 1 / np.sqrt(np.diag(partial_correlations))

partial_correlations *= d

partial_correlations *= d[:, np.newaxis]

non_zero = (np.abs(np.triu(partial_correlations, k=1)) > 0.02)

# Plot the nodes using the coordinates of our embedding

plt.scatter(embedding[0], embedding[1], s=100 * d ** 2, c=labels,

cmap=plt.cm.nipy_spectral)

# Plot the edges

start_idx, end_idx = np.where(non_zero)

# a sequence of (*line0*, *line1*, *line2*), where::

# linen = (x0, y0), (x1, y1), ... (xm, ym)

segments = [[embedding[:, start], embedding[:, stop]]

for start, stop in zip(start_idx, end_idx)]

values = np.abs(partial_correlations[non_zero])

lc = LineCollection(segments,

zorder=0, cmap=plt.cm.hot_r,

norm=plt.Normalize(0, .7 * values.max()))

lc.set_array(values)

lc.set_linewidths(15 * values)

ax.add_collection(lc)

# Add a label to each node. The challenge here is that we want to

# position the labels to avoid overlap with other labels

for index, (name, label, (x, y)) in enumerate(

zip(names, labels, embedding.T)):

dx = x - embedding[0]

dx[index] = 1

dy = y - embedding[1]

dy[index] = 1

this_dx = dx[np.argmin(np.abs(dy))]

this_dy = dy[np.argmin(np.abs(dx))]

if this_dx > 0:

horizontalalignment = 'left'

x = x + .002

else:

horizontalalignment = 'right'

x = x - .002

if this_dy > 0:

verticalalignment = 'bottom'

y = y + .002

else:

verticalalignment = 'top'

y = y - .002

plt.text(x, y, name, size=10,

horizontalalignment=horizontalalignment,

verticalalignment=verticalalignment,

bbox=dict(facecolor='w',

edgecolor=plt.cm.nipy_spectral(label / float(n_labels)),

alpha=.6))

plt.xlim(embedding[0].min() - .15 * embedding[0].ptp(),

embedding[0].max() + .10 * embedding[0].ptp(),)

plt.ylim(embedding[1].min() - .03 * embedding[1].ptp(),

embedding[1].max() + .03 * embedding[1].ptp())

plt.show()

作者:IVIVI_PLUS